More consumers are evaluating brands and making purchasing decisions based on environmental, social and ethical criterion, sometimes over cost. This shift in consumer consciousness means that corporate responsibility is no longer optional for brands that want to stand out in the marketplace.

More consumers are evaluating brands and making purchasing decisions based on environmental, social and ethical criterion, sometimes over cost. This shift in consumer consciousness means that corporate responsibility is no longer optional for brands that want to stand out in the marketplace.

A study on 2013-2018 U.S. consumers’ actual purchasing, showed that 50% of the growth in consumer-packaged goods (CPG), came from sustainability-marketed products. While taste, variety and brand remain strong influences, a Unilever study identified one in three (33%) people, in developed countries, purchase brands they believe are doing environmental good. Consumers in emerging economies trend higher in purpose-led purchasing. Global companies are addressing these trends by promoting environmental and social responsibility to boost their brand, while also enhancing the sustainability features and benefits of their products. The influx of new eco-brands is proof that companies see the opportunity for growth.

With opportunity, comes risk. Funding organizations like the Ellen MacArthur Foundation, consumer advocacy supports legislative policies and creates circular economies through extended producer responsibility (EPR). Policies require compliance, compliance requires change, and change is often hard. A multi-sector Public/Private partnership, The Product Stewardship Institute, has established framework legislation to ensure that EPR programs follow best practices, and industry organizations like the Sustainable Packaging Coalition and IDFA work to educate members on how to prepare for more prescriptive sustainability standards and regulations.

Even with these resources, it can be difficult to balance existing budgets with achieving new sustainability requirements. The challenge of balancing costs, marketability, and compliance are increased for family businesses and smaller operations in highly commoditized products and companies whose primary revenue comes from the sale of white-labeled products. Just as consumers look to corporations to lead in corporate responsibility, supply partners can help achieve product, packaging and value chain goals.

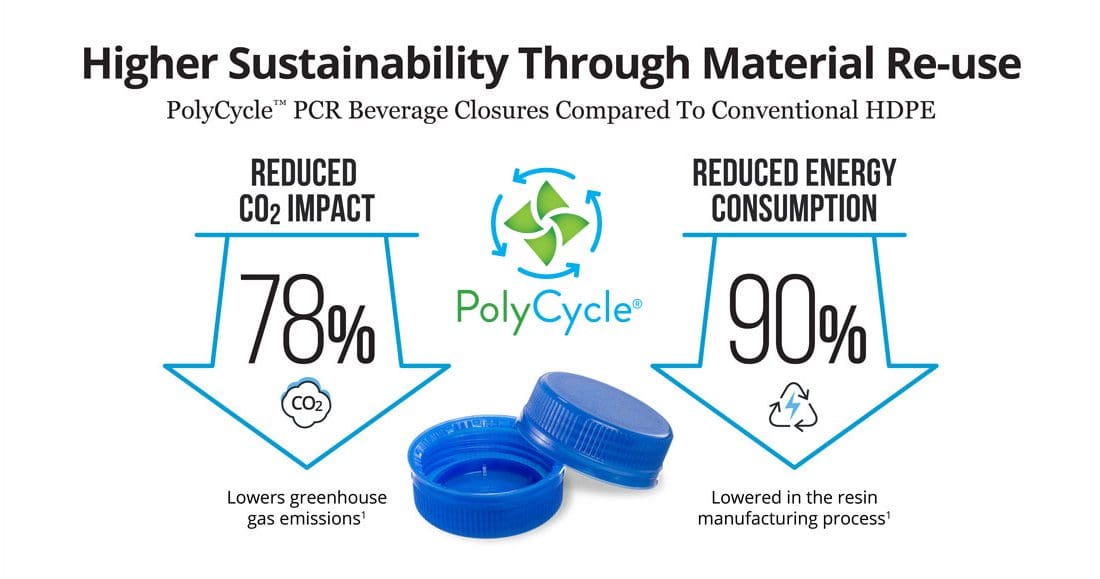

PolyCycle – Proprietary Post Consumer Recycled Resin

Liquid dairy packagers now have sustainable closure solution options to meet growing consumer demand and appeal to business development, brand and operations managers. PolyCycle is a new Post Consumer Recycled (PCR) resin developed to comply with stringent food and beverage packaging requirements. Innovated by Closure Systems International Inc. (CSI), PolyCycle PCR resin closures meet the performance requirements across six markets and achieved FDA-approval.

CSI helps customers improve consumer brand perceptions and prepare for EPR regulatory requirements by partnering to optimize closure design, minimize waste and maximize use of PCR content. CSI manufactures closures with up to 100% PolyCycle PCR , including HDPE and PP. These closures are also 100% recyclable at all standard recycling centers, helping to divert solid waste from landfills.

In the food and beverage industry, consumer experience is crucial, and CSI’s proprietary process eliminates smell, taste, and other potential contaminants, associated with using recycled materials. These FDA-grade PCR closures are commercially available for applications in still and sparkling water, carbonated soft drinks, non-carbonated beverages, liquid dairy markets, and various food and personal care applications.

PolyCycle moldable resin helps narrow the gap to true closed-loop recycled packaging. A small change like switching to a PCR closure can add up to make a big difference.

Engineered for Liquid Dairy

While many dairy processors may not require a fully sustainable option for their packaging, brands implementing PCR closures as a part of their business strategy demonstrate environmental and social responsibility. Closures made with PolyCycle are leading-edge packaging solutions.

CSI’s 38D-KL closure for liquid dairy is a precision-engineered and compression-molded cap that delivers reliable performance on HDPE and PET dairy bottles. The closure is chuck compatible for easy integration for most existing bottling lines. The closure is available with or without PolyCycle resin.

The innovation of PolyCycle to the beverage packaging industry may mark a tipping point in the marketplace. FDA-approved PCR closures drive sustainable innovation, tackle supply chain issues, strengthen brand engagement and optimize the total cost of operations. One example of a product development partnership committed to circularity is CSI’s PCR beverage closure design, which won the 2020 Caps & Closures Innovation Award at the Plastics News’ Plastics Caps & Closures annual conference in September 2020.

CSI has partnered with trusted companies to develop a robust supply source of high-quality materials. Customers can count on the highest level of quality control from sourcing to fulfillment. As an ongoing effort to support corporate sustainability, CSI maintains memberships with the Sustainable Packaging Coalition, the Association of Plastics Recyclers, and the U.S. Plastics Pact, aligning with the SDGs and tracking performance against the SDG Business Benchmarks.

CSI is headquartered in Indianapolis, IN, and produces 50+ billion closures annually across its nine manufacturing sites.

Sources:

1 Franklin LCI Data: 609 pounds CO2 per 1,000 pounds of material (22% of virgin) 78% less greenhouse gas emissions than virgin production. 90% less energy used than virgin resin. Water 543.3 gallons per 1,000 pounds of material.

Content provided by Closure Systems International and not written by the DairyReporter.com editorial team. For more information on this article, please contact Closure Systems International.